Summary

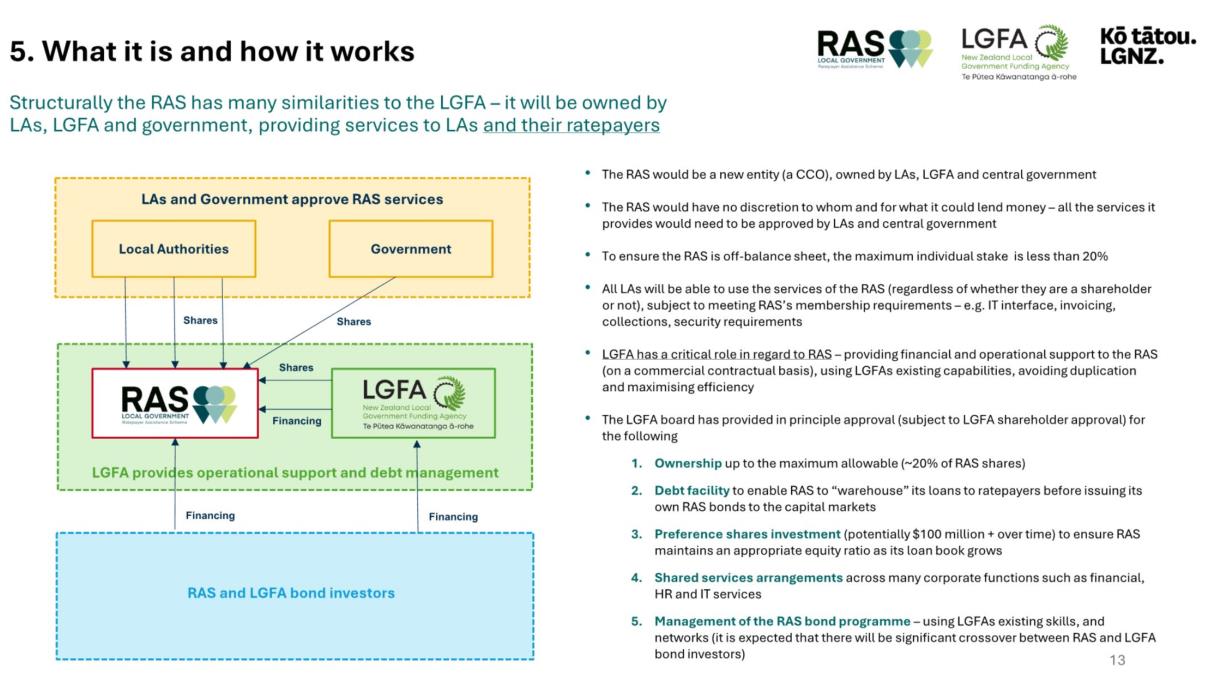

- The Local Government Funding Agency (LGFA), Local Government New Zealand (LGNZ), Cameron Partners, and “a group of metro councils” are planning to create a new finance company.

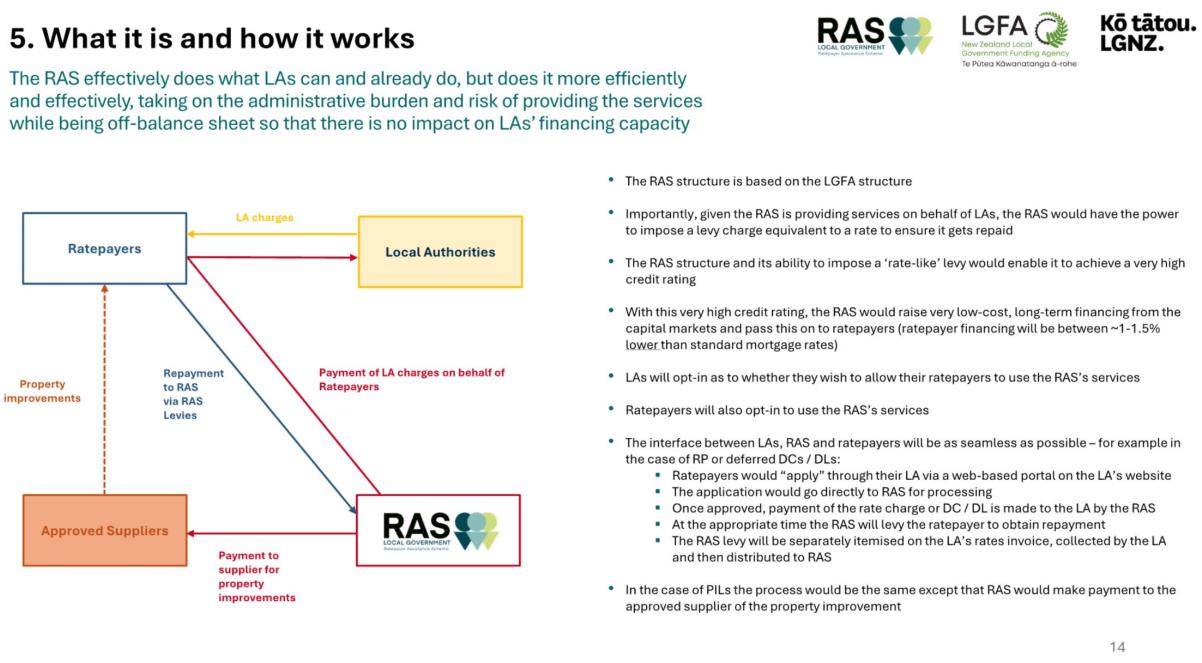

- This proposed new finance company would be a Council Controlled Organisation (CCO) and is called the Ratepayer Assistance Scheme (RAS).

- The RAS would largely function to loan out money so that ratepayers can cover the costs that their council has imposed on them.

- The RAS would offer what are essentially reverse-mortgages to people struggling to pay their rates.

- The RAS could also loan out money for “property improvements” and developer contributions/levies.

- The RAS is expected to benefit from a high credit rating due to its “structure” and ability to “impose a ‘rates-like’ levy”.

- Promotional material from LGFA and LGNZ claims that the RAS will then be able to offer financing to ratepayers at “between 1-1.5% lower than standard mortgage rates”.

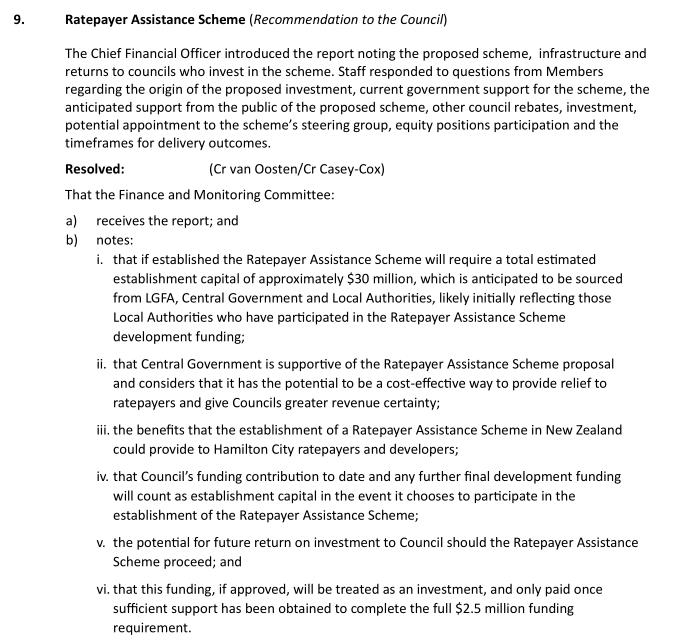

- Councils are expected to invest $2.5 million for the next stage of developing the RAS.

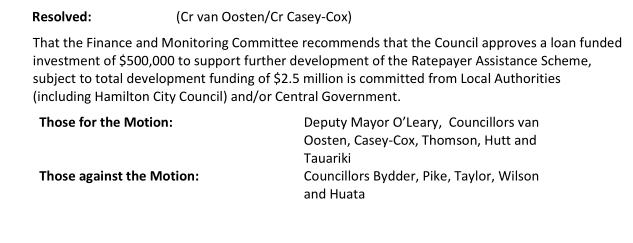

- On the 24th of June 2025, Hamilton’s Finance and Monitoring Committee voted to “recommend that the Council approves a loan funded investment of $500,000 to support further development of the Ratepayer Assistance Scheme”

- Councillors Bydder, Pike, Taylor, Wilson, and Huata voted against the recommendation.

Quotes and Excerpts

Finance and Monitoring Committee 24 June 2025 – Open Agenda

Finance and Monitoring Committee 24 June 2025 – Open (Unconfirmed) Minutes

Links

Meeting Agenda

Open (Unconfirmed) Minutes

Video of the Council meeting:

Further reading on this issue

Stuff Article: Why are councils considering rates hikes of 25.5% and higher?

OPINION: The 2025/26 HCC Budget – More of the Same and No “Fresh Thinking” (Yet) for Election Year